Overall Market Performance: Bitcoin, S&P 500, and Gold

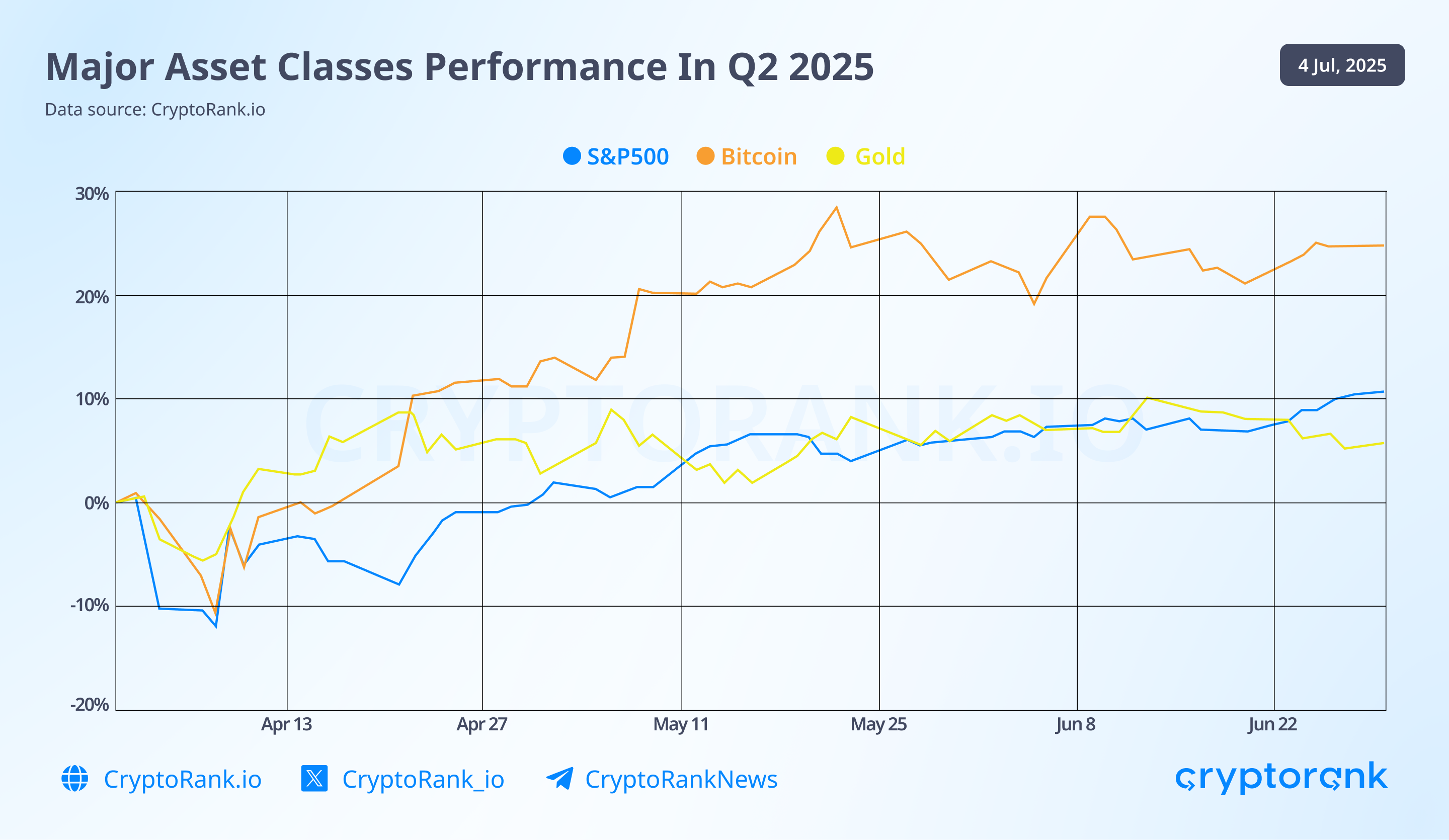

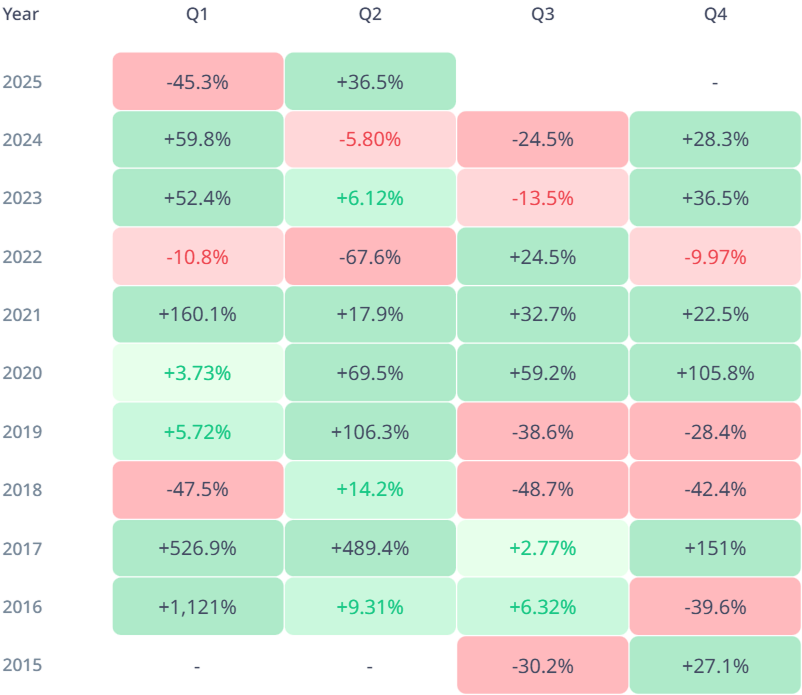

Q2 2025 was ultimately bullish across all three major asset classes — Bitcoin, the S&P 500, and gold, as each set a new all-time high during the quarter. However, the start of Q2 was marked by a sharp downturn triggered by President Trump’s surprise announcement of sweeping new tariffs.

The tariffs, in some cases reaching into the hundreds of percent, were imposed not only on traditional trade rivals and geopolitical competitors but also on strategic allies and countries with minimal trade conflicts with the U.S. The scale and speed of these measures shocked global markets, leading to a significant drop across Bitcoin, equities, and even safe-haven assets like gold.

In what appeared to be a tactical move, Trump later announced a 90-day pause on the tariffs to allow countries time to negotiate trade deals with the U.S. This move reassured markets, triggering a strong rebound. Bitcoin led the recovery, outperforming both the S&P 500 and gold as risk appetite returned.

Bitcoin

If you follow us on X or Telegram, you’ve likely seen several posts showcasing key metrics pointing to a bullish outlook for Bitcoin. In this section, we’ll summarize the most important indicators from Q2 that supported Bitcoin’s strong performance.

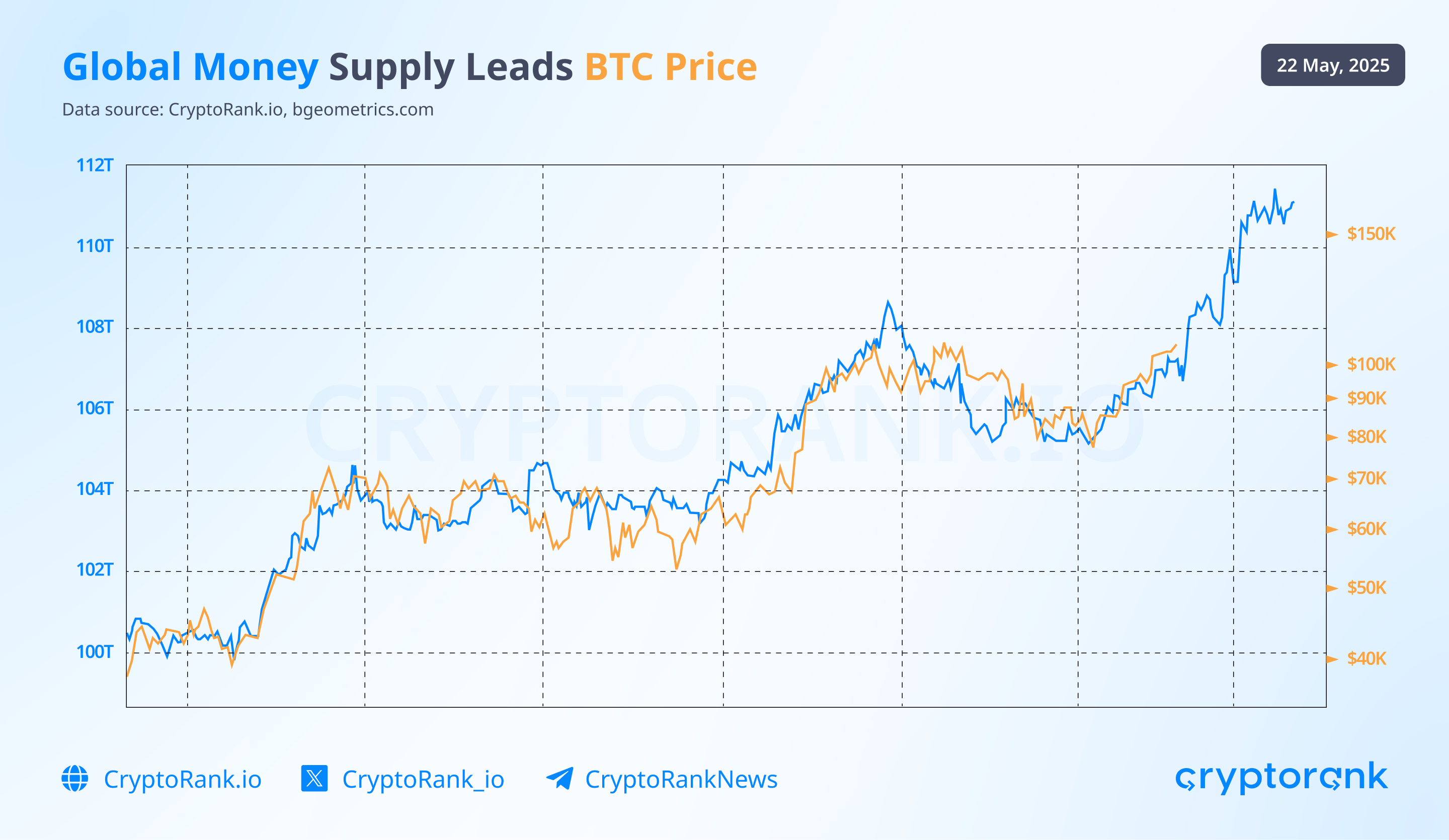

One of the standout signals was Bitcoin’s tight correlation with global M2 money supply. Based on the 10-week forward projection of global M2, this relationship continued to suggest upward momentum for Bitcoin—a trend that played out throughout the quarter.

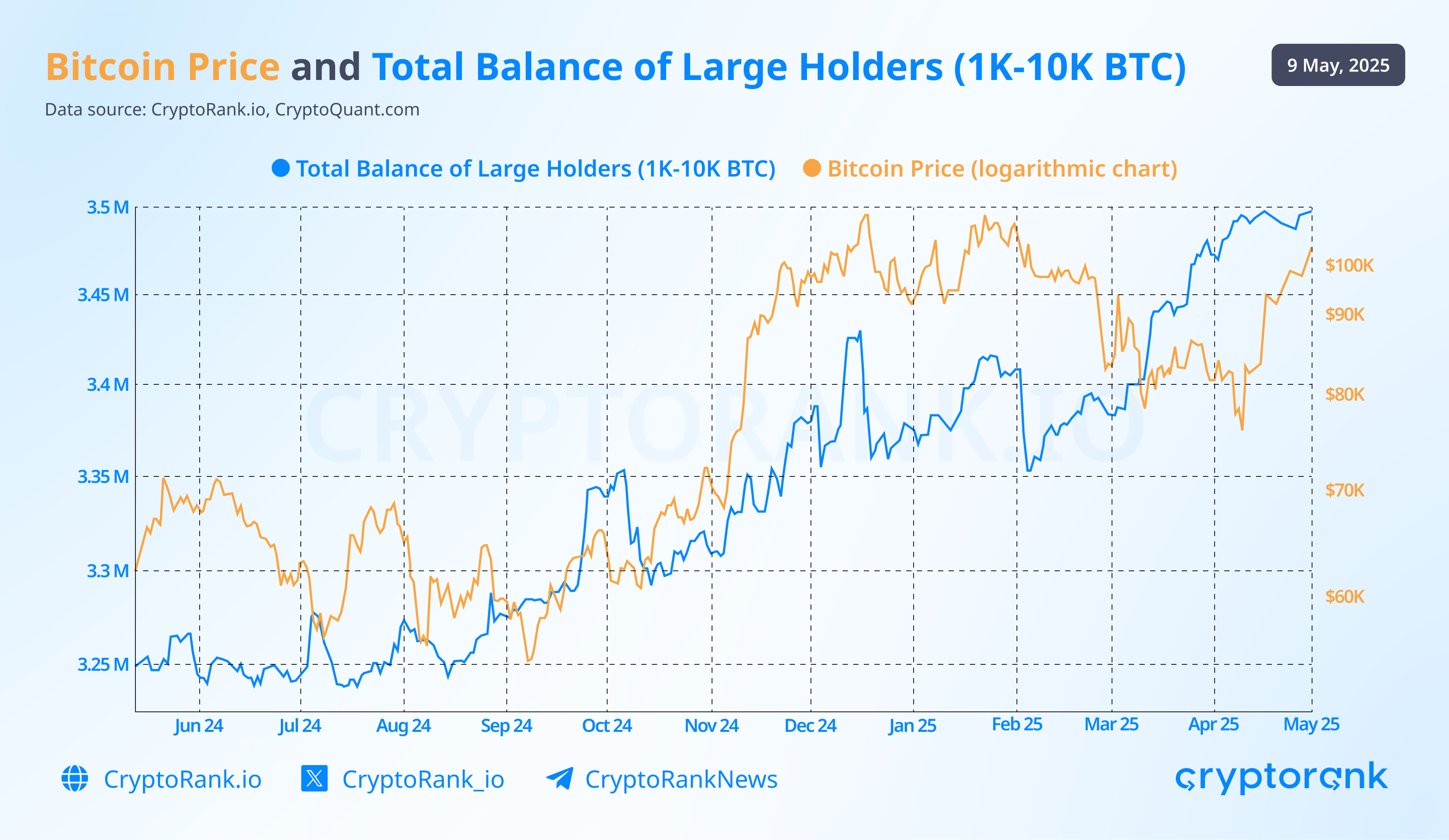

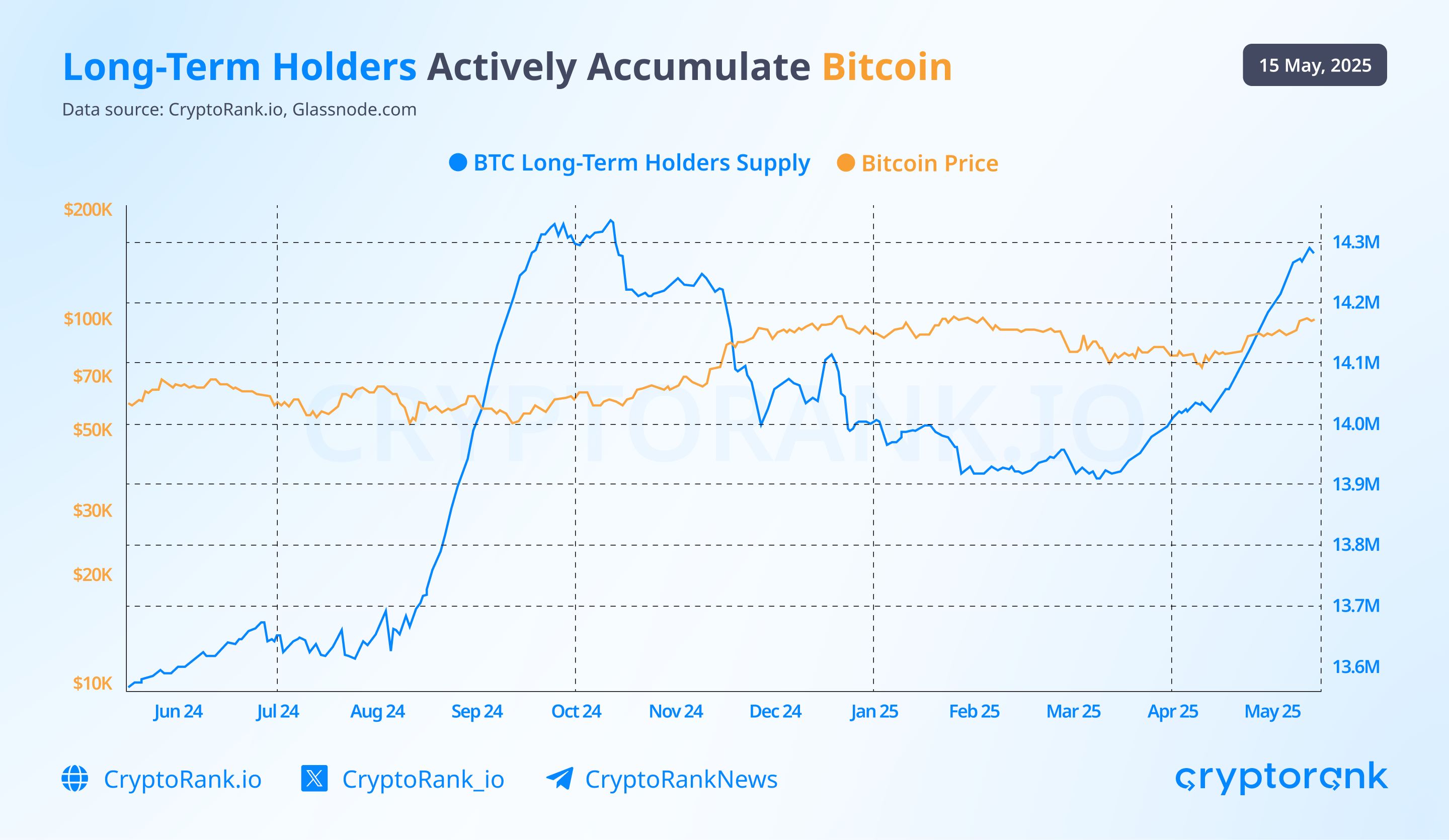

On-chain data also confirmed growing bullish sentiment. As highlighted in the infographic below, a specific group of market participants, often including institutional players like hedge funds and Bitcoin mining companies, have historically been reliable in signaling true market direction. Their activity in Q2 pointed to continued accumulation.

Long-term holders also kept increasing their Bitcoin positions, showing strong conviction from non-speculative investors. This behavior typically reflects confidence in Bitcoin’s long-term value.

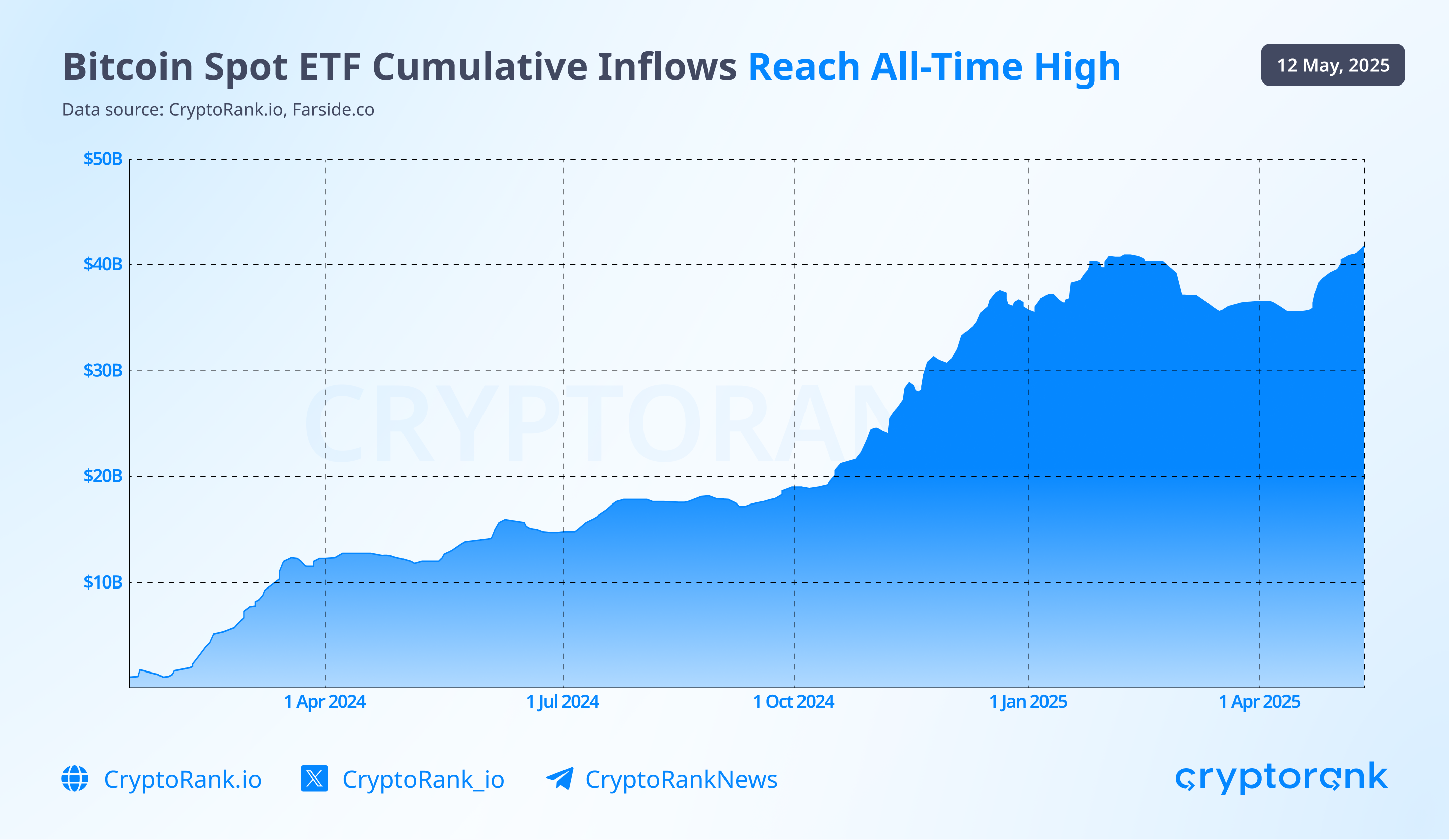

Institutional adoption played a critical role as well. BTC spot ETF issuers continued to increase their holdings.

With BlackRock becoming the second-largest holder of Bitcoin after Satoshi Nakamoto. For many institutions, ETFs remain the easiest and sometimes the only way to gain direct exposure to Bitcoin.

In fact, the number of publicly traded companies holding Bitcoin tripled in H1 2025 compared to 2024. This growth was fueled by increasingly crypto-friendly regulations in the U.S., which are accelerating corporate adoption. Rising geopolitical tensions also boosted Bitcoin’s appeal as a form of “digital gold” and a hedge against uncertainty.

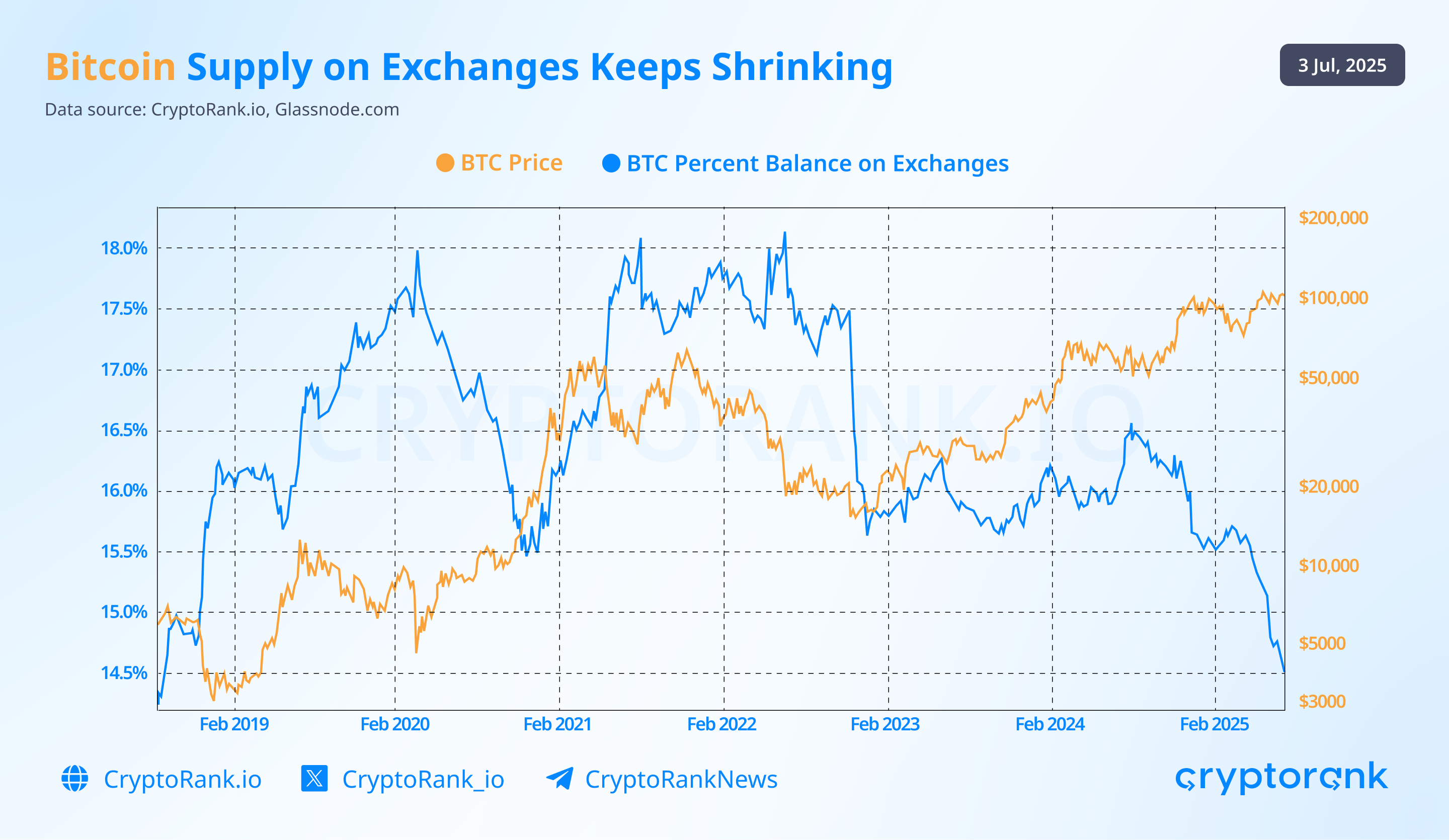

Another key indicator was the declining amount of Bitcoin held on centralized exchanges. This trend suggests a shift toward long-term holding and away from short-term speculation. It’s driven by multiple factors, including increased ETF custody, growing demand from institutions and retail investors alike, and the rise of Bitcoin DeFi—new protocols allowing BTC to be used outside of centralized platforms.

Taken together, these developments show a maturing market with growing long-term conviction. From macro trends and money supply signals to institutional flows and on-chain behavior, Q2 2025 was packed with bullish signals for Bitcoin.

To stay ahead of the curve, follow us on social media and keep reading our market recaps.

Ethereum

Q2 2025 marked the first time in a while that Ethereum outperformed Bitcoin in terms of price gains—a notable shift driven by several key developments.

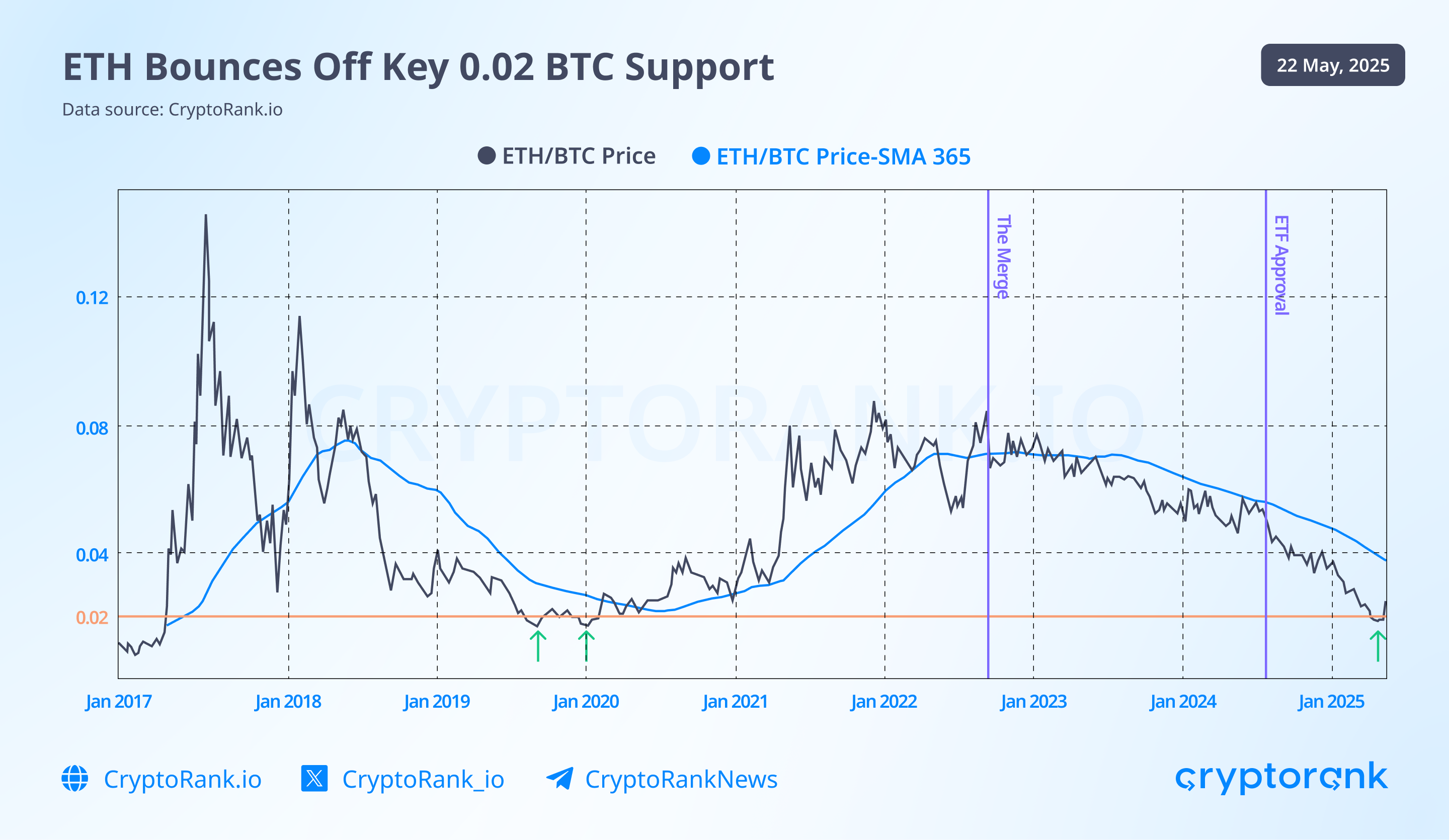

1. Key Technical Rebound

Ethereum reached a major support level at around 0.02 BTC per ETH, a historical floor that has acted as strong support multiple times in the past. The price bounced off this level, triggering renewed investor interest and bullish momentum.

2. The Pectra Upgrade

The most important technical catalyst this quarter was the Pectra upgrade, Ethereum’s most significant improvement since its transition to Proof-of-Stake. Activated on May 7, 2025, Pectra bundled 11 Ethereum Improvement Proposals (EIPs) aimed at boosting scalability, security, and user experience. We covered these changes in detail in our previous recap, and market participants clearly took note—Ethereum’s price reacted positively following the upgrade.

3. Rising Institutional Adoption

Institutional interest in Ethereum is on the rise, especially in the context of DeFi and RWA. Ethereum continues to serve as the backbone for tokenized financial infrastructure, making it increasingly attractive to professional investors.

On-chain data also pointed to sustained accumulation and confidence.

Thank for help

Thank you